Term Swap

Traders can submit Long Term Orders to TWAMM to sell a fixed number of assets on a fixed number of blocks, and TWAMM breaks these long-term orders into an infinite number of infinitely small virtual sub-orders that trade with the embedded AMM at a uniform rate over time. Dealing with these virtual sub-orders individually would cost an infinite amount of gas, but the TWAMM closed-form mathematical formula allows their cumulative swap proceeds to be calculated only when needed.

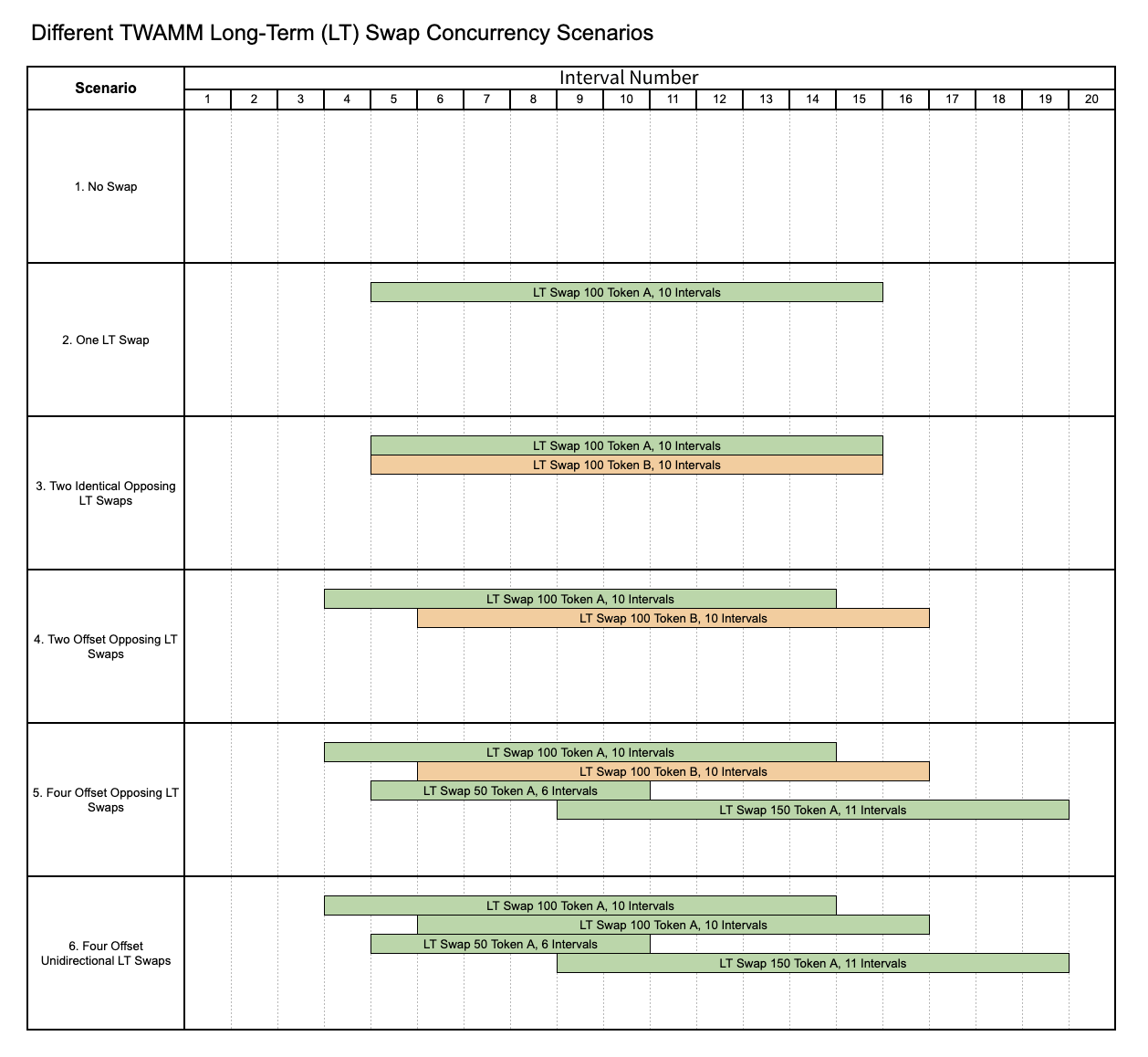

Long Term Swap Scenarios#

Another important factor in TWAMM is the Long Term Swap(LT-Swap) scenario. Real world TWAMM use would include the situation where there are one or more active LT-Swap, offset, and also occurring in opposite directions.

Consider a TWAMM pool consisting of Token A and Token B. Direction in this case refers to a swap from Token A to Token B—the opposite direction would be from Token B to Token A. Figure below illustrates some of the important possible LT swap scenarios. (In below picture , Order Interval = 5 blocks)

Unlike Instant Swap (one block) trades happening on AMMs today, we expect the trades on TWAMM to be particularly advantageous to long-term investors such as DAOs, funds, etc, and retail who are interested in utilizing TWAMM to enter/exit positions. Additionally, passive LPs who’ve been craving for a full range AMM since UNI V3 can now park their liquidity in TWAMM pools to earn significant returns without active management.